IEEE 2140.5-2020 pdf download.IEEE Standard for a Custodian Framework of Cryptocurrency

3. Custodian service of cryptocurrency

3.1 Overview of custodian service of cryptocurrency Asset Custodian Services mainly refers to services provided by third-party banks or securities firms in the financial and investment fields. For example, traditional equity investments or securities investment funds need to appoint a bank as a third-party custodian when completing fundraising to ensure that investors raise funds.

The funds raised by investors are segregated from the funds owned by the fund management firm, and are held in custody by a fair third party, so as to avoid any theft or confusion. With the increasing popularity of cryptocurrencies, the hosting of digital assets, especially token assets, has become a functional module for digital asset management. With the development of cryptocurrency compliance, asset custodian services also need to meet the needs of asset escrow. Blockchain systems support asymmetric encryption and have a couple of keys (a public key and a private key).

Blockchain customers, especially the token holders, publish the public key and could verify and sign the passing messages with the private key. For token holders, the passing messages are token transferring and exchange. When focusing on the custody of token assets, we are talking about the management of “private keys.” Key distribution and management in traditional cryptography have been a topic of long-term discussion and continues to evolve. In blockchain systems, key distribution and management determine the ownership of assets. Therefore, the core of token asset custody is a set of services based on the management and control of “ownership” of key-based assets.

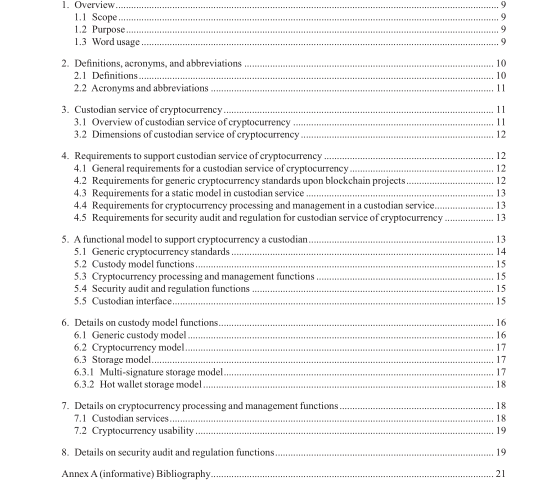

A view of custodian framework in blockchain to support fnancial services is described in Figure 1.

There are three types of functions in the custodian framework in blockchain, that work with cryptocurrency fnancial systems, namely, custody model functions, cryptocurrency processing and management functions, and trust audit and regulation functions. Furthermore, the framework serves token assets as well. Cryptocurrency custodian services, as part of token asset custodian service, have to satisfy more regulation requirements. The details on these functions are elaborated in Clause 6.

3.2 Dimensions of custodian service of cryptocurrency In the Static Custody Model, cryptocurrency and token assets go live in distributed ledger technology systems, especially public blockchain systems. The Static Custody Model provides the capability to enable entities, cryptocurrency and token assets, and operation definitions in blockchain systems to other financial systems based on custodian services.

In dynamic runtime of cryptocurrency processing and management, the cryptocurrency processing and management runtime in a custodian framework provides the capability to trace cryptocurrency processing and control the accessibility for entities accessing cryptocurrency. In trust functions for audit and regulation, asset custodian service provides audit of the processing, management, ownership and accessibility of cryptocurrency and token asset. In some regions, asset custody is under escrow; thus, asset custodian service has to be able to support the regulation.

4. Requirements to support custodian service of cryptocurrency

The custodian service is to provide cryptographic protocol and technical solution to manage the “key” of cryptocurrency and token assets, make full control of the ownership and accessibility of the cryptocurrency and token asset. Therefore, the combination of custodian framework and blockchain system constructs a reliable solution to enable asset custody and traceability of custody processing and management. To support a custodian service of cryptocurrency, the 4.1 through 4.5 are required to be considered.

4.1 General requirements for a custodian service of cryptocurrency

To ensure the appropriate level of asset custody, the following aspects are required:

— Capability to manage cryptocurrency and token assets in various distributed ledger technologies,especially public blockchain projects

— Capability to provide defnition for custody procedures and full supporting by technical architecture

— Capability to support audit from both internal and external

— Capability to support regulation or escrow in regions

— Capability to provide extended standard interfaces for docking third-party fnancial services.IEEE 2140.5 pdf download.IEEE 2140.5-2020 pdf download

IEEE 2140.5-2020 pdf download

Leave a Reply